In 2014 we achieved significant milestones and made important progress on various fronts.

The repayment of TARP and the restructuring of our U.S. operations were two of our main achievements during the year. Including the impact of these events, we reported a net loss of $313 million. Although these actions affected the year's results, we are now in a much stronger position moving forward. Adjusted net income for the year, excluding these events, was $301 million. These solid results in 2014 were driven by higher net interest income due to lower interest expense, a lower provision for loan losses, lower operating expenses, mainly pension costs and FDIC insurance, and lower income taxes.

Credit quality remained stable despite the challenging economic conditions in Puerto Rico. Net charge-offs declined in Puerto Rico and the United States, both in absolute terms as well as a percentage of loans. Nonperforming loans as a percentage of total loans closed 2014 at 2.95%, fairly stable when compared to the previous year if we exclude loan balances from the regions that were sold as part of the U.S. restructuring. While we remain vigilant due to economic conditions in Puerto Rico, we are encouraged by the general performance of our portfolios.

We continue to enjoy strong capital levels relative to peers and regulatory requirements. Our Tier 1 common equity ratio stood at 15.9% at year-end, or 110 basis points higher than in 2013, which still included our TARP capital. The repayment of TARP funds, completed in July of 2014 without issuing additional equity, better positions us for more active capital management in the future.

The restructuring of our U.S. operations was a defining event of 2014. In April, we announced our plan to sell our California, Chicago and Central Florida regions in order to focus our business on the New York Metro and Miami regions. The plan also includes the transfer of most support functions to Puerto Rico and New York to leverage the talent and infrastructure we have in place in our headquarters and to benefit from Puerto Rico's lower personnel cost structure. During the course of the year, we completed the sale of the three regions and made significant progress in the operational restructuring. Once the transfer of support functions is completed in the first half of 2015, we will have reduced the number of back-office employees supporting our U.S. operations by 43%, with approximately twothirds of them based in Puerto Rico. I would like to acknowledge the hard work of all of our colleagues at Popular Community Bank and those supporting them in Puerto Rico that have made possible the successful execution of an extremely complex restructuring project. We are now ready to move forward with a leaner, more focused operation in the U.S.

Our franchise in Puerto Rico was strengthened in 2014. We increased our market share in most categories and maintained our leadership position in the majority of them. In the auto business, where we have intensified our sales efforts, we reached the second position in the market for the first time. Despite a weak Puerto Rico economy, we also experienced growth in the corporate segment.

We deepened our efforts to enhance service and offer greater convenience to our clients. Most business units improved their customer satisfaction metrics. Results reflect the conscientious effort of all groups, as well as initiatives related to efficiency that have also had a positive impact on customer satisfaction. The redesign of branch processes, based on the LEAN methodology, was completed in 17% of our branches which account for 28% of total transactions. Results to date in these branches show higher service levels and significant reductions in waiting times. As we roll out this project to other branches, we expect to see additional improvements in our customer satisfaction. We also continued the implementation of projects designed to transform our retail delivery network, placing a greater emphasis on digital transactions. The digitalization of our clients' interactions is a critical move to offer convenient alternatives and generate cost efficiencies. In December of 2014, deposits made through automatic teller machines (ATMs) in Puerto Rico reached 29% of deposits in branches with upgraded ATMs, compared to 17% in December of 2013. At the same time we migrate transactional, service and sales interactions to digital channels, we will revise our physical footprint in order to meet our clients' needs in a more effective way.

We also embarked on several key initiatives regarding our most important asset — our people. In August, we increased the minimum hourly base salary for all our employees in Puerto Rico to $9.00, which applied to approximately 2,400 of our colleagues. In 2015 we will increase salaries to $10.00 for those employees demonstrating good performance. We are well aware that it is critical to attract, retain and develop the best talent available in order to reach our ambitious goals. We are convinced that this investment will produce benefits in terms of retention, engagement, customer service and productivity. Another important event this year was the inauguration of the On-Site Health and Wellness Center in Puerto Rico, focused on the prevention and early detection of health conditions. The objective of this innovative approach is to improve the health of our employees, which will translate into lower medical expenses and increased productivity. As a result of these and other efforts, our employee engagement metrics, which were already solid, improved even more in 2014. We are continuously raising the bar, expecting a higher level of performance from our employees. We feel confident that our focus on performance, coupled with the investments we are making on our people, make them our strongest competitive advantage.

Our commitment to our communities continued unabated. We expanded our financial education program Finance in Your Hands, which has reached over 100,000 individuals in Puerto Rico and was recognized by the American Banking Association as the best financial education program in the United States. We remain committed to Echar Pa'lante, a multisectoral social collaboration program we launched in 2011, that has brought together over 300 organizations and experts to foster education and entrepreneurship. Employee contributions to our foundations increased in 2014, reaching $730,000. In large part thanks to these contributions, Fundación Banco Popular and the Popular Community Bank Foundation donated over $3.1 million to 128 nonprofit organizations. Volunteerism also remained strong. Our employees donated their time to collaborate with many of the organizations we support financially. In December, as part of the celebration of the 35th anniversary of the Banco Popular Foundation in Puerto Rico, we inaugurated its new headquarters. In addition to serving as a home to our Foundation, the building houses 11 other nonprofit organizations, turning our space into a center for collaboration and social innovation.

Click To Enlarge

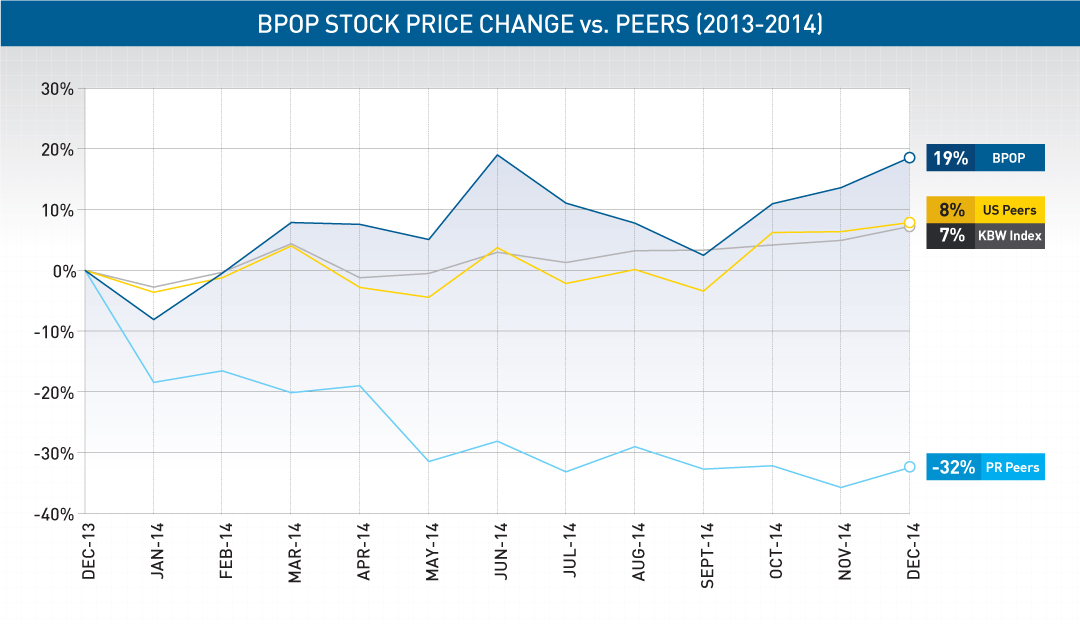

Our stock closed the year at $34.05, 19% higher than at the end of 2013. This performance compares favorably to that of industry indices, our U.S. peers, and other banks in Puerto Rico.

In September of 2014, Ignacio Alvarez, Esq. was named President and Chief Operating Officer of Popular, Inc. and Banco Popular de Puerto Rico, as well as President of Banco Popular North America. Ignacio had been serving as General Counsel since 2010, demonstrating outstanding leadership and making important contributions in strategic initiatives across the organization.

We are pleased to have brought on board Javier D. Ferrer, Esq. as the new General Counsel and Secretary of the Board of Directors of Popular, Inc. As one of the founding partners of Pietrantoni Méndez & Alvarez LLC and a former president of the Government Development Bank for Puerto Rico, Javier brings with him extensive experience in the corporate and banking law fields and has been a great addition to our team.

I want to express my deepest gratitude to Jorge A. Junquera for 43 years of outstanding service to Popular. From his early years in Investments, to his most recent role as ViceChairman, Jorge's passion and dedication made him an integral part of the management team. It is impossible for me to enumerate the countless initiatives he led, but I would like to highlight that his advice, expertise and leadership during his 17 years as Chief Financial Officer were key to help strengthen the financial position of our organization.

Finally, I would also like to acknowledge Samuel T. Céspedes, Esq. who decided to retire after serving as the Secretary of the Board of Directors for 24 years. I know I speak on behalf of the entire Board when I say that we are all grateful for his commitment and his contributions throughout these years.

As you can see, our accomplishments for 2014 extend well beyond financial results. They demonstrate how commitment to our clients, employees, shareholders and communities translates into concrete results that pave the way for future successes.

I am grateful to the management team and Board of Directors for their support and leadership. They are responsible for all of these achievements.

The year 2015 brings a new set of opportunities and challenges. In the case of our U.S. operations, we will complete the transfer of the support functions to Puerto Rico and, at the same time, strive to achieve aggressive business goals. In Puerto Rico, the economy still presents significant challenges, but we will remain focused on serving our clients and growing our business where opportunities exist.

I am confident that, guided by clear objectives and energized by the opportunities that lie ahead of us, we will continue forging ahead in 2015.